Imagine a world where your money isn’t controlled by banks or governed by a state entity. Welcome to the realm of Bitcoin—a digital currency that offers a new approach to financial freedom and anonymity. In this article, we’ll explore the fundamentals of Bitcoin, its technology, and its potential to change the financial landscape.

What is Bitcoin?

Bitcoin is a form of digital currency, created and held electronically. Unlike traditional currencies, no one controls Bitcoin. It’s the first example of a growing category of money known as cryptocurrency. It was invented by an anonymous person or group of people under the name Satoshi Nakamoto and released as open-source software in 2009.

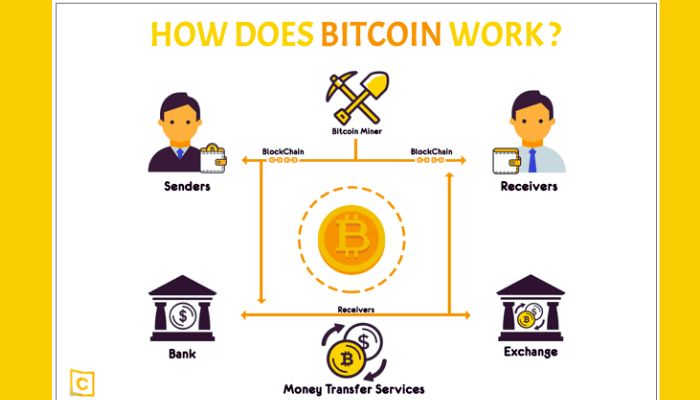

How Does Bitcoin Work?

Transactions

Bitcoin transactions are sent from and to electronic bitcoin wallets, and are digitally signed for security. Everyone on the Bitcoin network knows about a transaction, which is recorded in a ledger called the blockchain. This process helps the system to verify the transaction’s validity.

Mining

Bitcoin mining involves solving complex mathematical problems that are necessary to confirm transactions and increase security. Miners are rewarded with newly created Bitcoins and transaction fees. As more Bitcoins are mined, these problems become more complicated, making mining a challenging task.

Wallets and Storage

Bitcoins are stored in digital wallets, which can be hardware-based or software-based. The wallet can be on a computer, a mobile device, or a dedicated hardware device. Security practices such as two-factor authentication and backups are essential to protect against theft and loss.

Benefits of Bitcoin

Decentralization

The decentralization of Bitcoin is perhaps its most profound allure. Without a central point of control, such as a bank or government, the currency remains free from political influence and corruption.

Lower Transaction Fees

For international transfers, the fees associated with Bitcoin are significantly lower than those charged by banks and other financial services.

Accessibility

Bitcoin provides an opportunity for people without access to traditional banking systems to send and receive money.

Potential for Appreciation

Despite its volatility, Bitcoin has shown substantial growth since its inception, attracting many from the investment community.

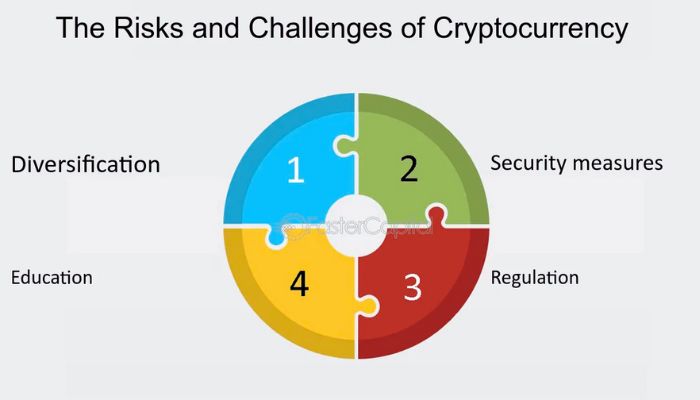

Risks and Challenges

Volatility

Bitcoin’s price is known for wild swings, which can result in high profits or devastating losses.

Security Issues

While secure, Bitcoin is not impervious to theft. Phishing, hacking, and other attacks are common security concerns for Bitcoin holders.

Regulatory Challenges

Bitcoin’s legal status varies substantially from country to country. While some have embraced it, others have imposed significant restrictions.

Environmental Concerns

Bitcoin mining consumes a tremendous amount of energy, leading to an increased carbon footprint.

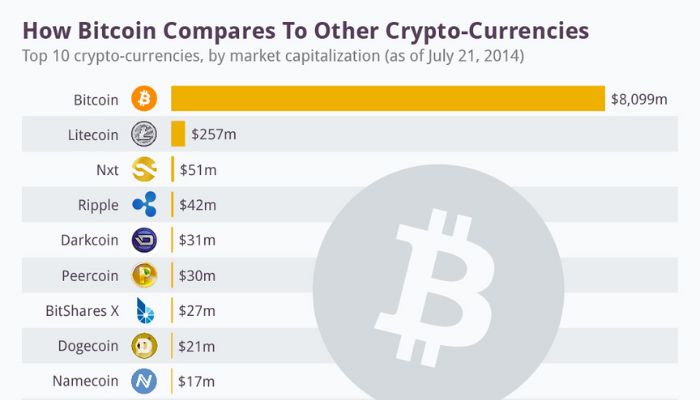

Bitcoin vs. Other Cryptocurrencies

While Bitcoin was the first cryptocurrency, many others like Ethereum and Ripple have emerged with distinct functions. Ethereum, for instance, offers complex contracts that can be programmed to complete automatically.

Real-World Applications of Bitcoin

From small boutiques to large retailers, many businesses worldwide accept Bitcoin as payment. Its ability to facilitate fast and secure cross-border transactions makes it particularly valuable in the global digital economy.

The Future of Bitcoin

Experts remain divided on Bitcoin’s future. Some see it as the future of money, while others predict a decline. Technological advancements, like the Lightning Network, could significantly enhance its functionality and adoption.

Conclusion

Bitcoin stands as a transformative digital currency that offers a unique approach to money. Its integration into the global economy suggests a promising future, despite its associated risks and volatility. As it continues to evolve, it remains a fascinating development in the world of finance.

FAQs About Bitcoin

What is Bitcoin?

Bitcoin is a digital currency, also known as a cryptocurrency, which operates independently of a central bank. It uses decentralized technology (blockchain) for secure payments and storing money that doesn’t require banks or people’s names.

How does Bitcoin work?

Bitcoins are transferred from one user to another through the internet, without going through a bank or clearinghouse. Every transaction is recorded in a public list called the blockchain, which ensures the security and integrity of transaction data.

Can Bitcoin be converted into cash?

Yes, Bitcoin can be converted into cash at a cryptocurrency exchange, through peer-to-peer transactions, or at a Bitcoin ATM. You can sell your bitcoins and have the money transferred to your bank account, or withdraw cash.

How do you buy Bitcoin?

You can buy Bitcoin through:

- Cryptocurrency exchanges: Places like Coinbase, Binance, and Kraken allow you to buy, sell, and hold cryptocurrencies.

- Bitcoin ATMs: These are physical machines located in public places that allow you to Bitcoin kopen and other cryptocurrencies using cash.

- Peer-to-peer platforms: Websites like LocalBitcoins allow you to trade Bitcoin directly with other users.

Is Bitcoin legal?

The legality of Bitcoin varies by country. In most developed countries, using Bitcoin is legal. However, some countries have heavily restricted or even banned the use of cryptocurrencies. It is essential to check the laws in your specific location.

Is Bitcoin secure?

Bitcoin as a system is extremely secure thanks to the blockchain technology and various cryptographic techniques. However, the security of your Bitcoin also depends on how you store and manage them. Using strong passwords, two-factor authentication, and cold storage (keeping your bitcoins offline) can help protect your assets.

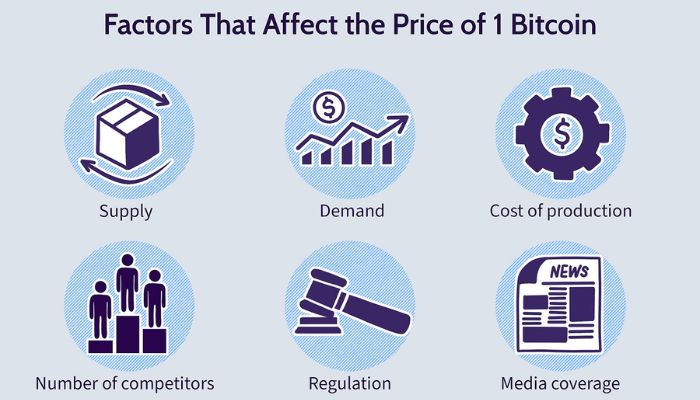

Why do Bitcoin prices fluctuate so much?

Bitcoin is known for its price volatility. Several factors contribute to this:

- Market demand: As more people buy Bitcoin, the price goes up, and when fewer people buy, the price goes down.

- Media influence: Positive or negative news can cause prices to fluctuate.

- Regulatory news: Announcements from governments about regulations, legality, or other decisions can affect the price.

- Technological changes and updates: Developments within the Bitcoin network, such as forks or updates, can also impact Bitcoin prices.

What can you buy with Bitcoin?

Many businesses and retailers have started accepting Bitcoin as a form of payment. You can buy everything from your morning coffee to cars, real estate, and more with Bitcoin. Moreover, many e-commerce platforms allow purchases with Bitcoin.

How many Bitcoins are there?

The total supply of Bitcoin is capped at 21 million. As of now, over 19 million Bitcoins have been mined. The supply limit is a critical feature that ensures that Bitcoin will not experience inflation in the same way that traditional currencies might.

What happens when all 21 million Bitcoins are mined?

The last Bitcoin is expected to be mined around the year 2140. Once all Bitcoins are mined, miners will no longer receive block rewards. However, they will still be compensated through transaction fees paid by those making transactions. This is intended to ensure that miners have an incentive to maintain the network’s integrity.